Renting a car can be your lifesaver if you do not have your own car at the moment but you need a fast and reliable means of transportation. However, renting a car without proper insurance can turn into a nightmare if you are involved in a traffic accident. That is why we are talking today about two kinds of rental car insurance: Collision Damage Waiver (CDW) and Supplementary Liability Insurance (SLI).

What Are CDW and SLI for Rental Cars?

Firstly, CDW stands for Collision Damage Waiver. This type of insurance pays for damage to your hired car but it usually excludes windscreens, tires, undercarriage, replacement locks, replacement keys, and towing charges. Notably, CDW is almost always included in your rental package but in the United States, that’s not always the case and you have to pay for it separately.

Besides, LDW, representing Loss Damage Waiver (which includes CDW and Theft Protection), will make you no longer worry about the costs of replacing the car if it is stolen.

Secondly, SLI is short for Supplementary Liability Insurance. This type of insurance provides you with third-party liability protection. In other words, it covers the claim of the third party’s bodily injury/death and property damage in an accident if you are legally responsible for. However, in some countries such as the United States, the SLI insurance limits are quite low, so we suggest you top it up.

Besides, the term “SLI” may vary depending on the car rental company you use, also known as ALI, represents Accident Liability Insurance or LIS, represents Liability Insurance Supplement. However, no matter which of these terms you encounter, you should consider getting it.

To sum up, CDW and SLI are introduced as standard insurance in your car rental package in most countries. However, as mentioned above, why is CDW not always included in U.S. car rental? Let’s move on to this question and another of the most common question our customers ask us: “Do I need SLI in the United States?”.

Why is CDW not always included in U.S. car rental?

Because you may have been insured by your personal car insurance or your credit card company!

1)Personal Car Insurance: American citizens with their own cars are usually covered by their own car insurance, thus if you have your own car, remember to check your own insurance plan (or you can call your insurance company directly) before you get to the rental desk. You may already have the insurance plan such as CDW/LDW or even the liability insurance they want you to buy, but you should be careful as there are always exceptions.

2)Credit Card Car Rental Insurance: In the United States, most credit card companies such as Visa cards, American Express cards, and other travel-friendly credit cards, offer CDW/LDW in primary coverage for your rental car. Thus, remember to obtain proof from your credit card provider that this cover is included on your card and extends to the country of rental. However, they may only cover rented cars in the U.S. for two weeks or less due to their insurance policy restrictions.

Do You Need SLI in the USA?

In a nutshell, yes.

Although CDW/LDW is most likely provided, personal liability insurance is not covered by these credit cards. That means primary rental car coverage with a credit card only pays for damages to your rental car rather than other cars.

However, the rental agreement may provide primary coverage for third party liability as car rental companies in the United States are required to provide mandatory minimum liability coverage on car insurance policies but this is a very low amount, normally between $5,000 and 20,000 coverage or only meet the “state minimum” policy. That is why we advise you to take Supplemental Liability Insurance (SLI), which supplements the coverage of personal auto insurance, up to an estimation of $1,000,000. And it generally costs $5 to $15 per day depending on the type of vehicle, length of rental, and rental company. It is your best interest to purchase SLI.

A very important thing to note is that drivers are required to show proof of insurance at traffic stops/accidents. Driving without insurance can result in a fine up to $500 or up to $10 if you fail to show proof of insurance at the time. Therefore it is wise to carry it with you at all times.

Aside from CDW and SLI, click here to see if you need PAI and choose your perfect car rental insurance.

Hey! Check to see if you understand CDW & SLI!

Scenario 1

Mr. Customer was driving a rented car in Las Vegas and had CDW and third party liability protection. Unfortunately, he ran into a tree and the window broke and the right front door was scratched. The repair of the window is $400 and the repair of the door is $800. How much should Mr. Customer pay?

Scenario 2

Mr. Customer was driving a rented car in Las Vegas and had LDW and third party liability protection. Unfortunately, as it was his fault, he hit someone’s car and the window broke and his right front door was scratched. The worst thing was the other party (both the driver and his car) was hurt badly. Still, the repair of the window is $400 and the repair of the door is $800. But the other party’s medical expense and any additional claims up to $16,000. If the third-party liability protection provides coverage of $5,000, how much is Mr. Customer obligated to pay? What if Mr. Customer accepts SLI at the rental desk?

Side note: Find the answers at the end of this article!

Car Rental Insurance in QEEQ.COM

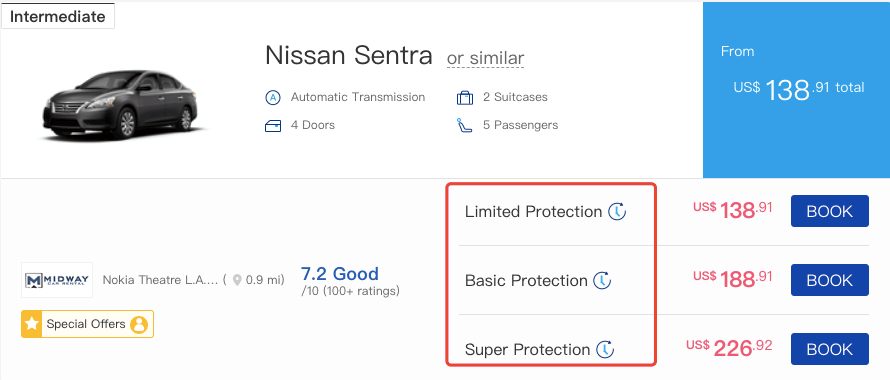

To simplify your rental decision, QEEQ.COM lists insurance inclusions detailedly of all rental packages, where applicable, on the right side of the listing page. You can learn the differences between “No Protection”, “Limited Protection”, “Basic Protection”, “Full Plus” and “Super Protection” by hovering over each of them. Click here and find the above-mentioned insurance coverage plans in detail.

A typical listing page from QEEQ.COM displaying car rental packages with different insurance coverage for a particular car type/car group.

The answer to Scenario 1:

$400. CDW will pay $800 for the scratched door but the repair of the window is usually excluded. Mr. Customer is responsible for the window cost.

The answer to Scenario 2:

$11,400 if the third party liability protection provides coverage of $5000, of which $400 is the damage fee of the window, and $11,000 is the amount after deducting the coverage of $5000, that is $16,000-5000=$11,000.

However, if Mr. Customer accepts SLI at the rental desk, he will only pay $400 for the window. $16,000 will be claimed in the SLI (up to $1 million).

Visit QEEQ.COM now.

QEEQ.COM guarantees the most competitive car rental deals for your travel and the secret is our Price Drop Protector program! We can automatically track your rental rates and RE-BOOK you if prices drop! See how our customers love this feature here.

very good. Thank you…