What is PAI for rental cars?

Personal Accident Insurance (PAI) entitles you and your passengers to medical, ambulance and death benefits in the event of an accident. Its standard level of coverage is capped at certain amounts which are usually set by insurance companies and rental locations.

Personal Effects Coverage (PEC) – another term that you may come across – is often bundled with PAI. In cases of loss due to theft, PEC covers any of your personal belongings in the car during the leasing period. But compensation for losses is typically capped per person and per accident, following the Terms and Conditions laid out by each insurance and/or car rental company.

Cost per day: Typically, PAI costs around $5 to $10 per day in the USA, but when bought together with PEC, the cost may reach $11. One thing to be noted that is PAI/PEC policies may vary depending on the coverage, car rental company, taxes, and fees, so be sure to check what is being offered before purchasing insurance and picking up your car.

Do you need PAI?

1) When you don’t need PAI?

First of all, you are not required to purchase PAI; it is optional insurance for car rental, so you can decide whether to buy it based on your needs. Secondly, if you are already covered by health, life or automobile insurance plans that you have purchased, chances are that some benefits may duplicate coverage that PAI offers. Besides, some PAI benefits may duplicate coverage that the rental company must provide under state law.

Thus, you can consider not buying PAI when renting a car if you have already purchased the following insurance plans:

- Life insurance: you will be covered in cases of death during traveling.

- Credit card rental car insurance: if you are paying for your car rental with your card, you might already have AD&D (Accidental Death and Dismemberment) coverage.

- Health insurance: it is likely that your health insurance offers car rental accident coverage. If you have health insurance that covers you for injuries due to an accident, then you won’t need to purchase additional PAI.

- Other insurance: Many types of insurance have similar forms of coverage offered by PAI yet we haven’t mentioned. We suggest you check with your insurance companies to see if you can be protected under your existing insurance.

Note: As always, be sure to check with your insurance company or credit card company to see if its coverage is sufficient for you and your passenger’s needs and if its coverage extends to the country of rental.

2) So when should you purchase PAI?

If you haven’t purchased the aforementioned insurance plans or any other types of insurance that can protect you during your rental period, and you do not want to solely rely on another driver’s third-party insurance coverage, you should consider purchasing PAI.

How to choose your PERFECT car rental insurance?

With a large number of insurance plans on offer, it may be confusing and daunting for those unfamiliar with it all. Below is an infographic that highlights and simplifies 5 car rental insurance, including PAI and PEC, that are commonly offered car rental insurance packages. This will help you find the exact car rental insurance plan that you need in no time.

Mind Map: How to choose your perfect car rental insurance in 10 minutes or less?

Description of the Mind Map above:

- In cases where you have caused a traffic accident, CDW protects your rented car, and TPL/SLI covers the other damaged car(s).

- In cases where you have caused a traffic accident, PAI covers physical injuries that you may have suffered. The third party’s driver and passengers can be covered through TPL/SLI.

- When faced with theft, the loss of a car can be insured through TP.

- When faced with theft, your personal belongings/personal effects can be insured through PEC.

Aside from PAI and PEC, the other three types of insurance shown in the table are Collision Damage Waiver (CDW), Theft Protection (TP) and Supplementary Liability Insurance (SLI). And it is important to note that CDW and TP can be collectively referred to as a Loss Damage Waiver (LDW). Let’s delve deeper into each one:

- Collision Damage Waiver (CDW)

During the rental period, CDW covers physical damage that the car might suffer in the event of an accident. However, it usually comes with some exclusion – for example, it might not cover damage to windscreens, tires, undercarriage, replacement locks, replacement keys, and towing charges.

- Theft Protection (TP)

TP covers part of the cost for replacing the hire car if it’s stolen or damaged as a result of attempted theft, while you have it. However, TP coverage excludes items inside the car, such as your luggage, phone or GPS.

- Loss Damage Waiver (LDW)

Some car rental companies combine CDW and TP into LDW. Coverage for both CDW and LDW are similar – both waive your financial responsibility for any damage that the rental car might incur. So don’t worry if you see that your voucher shows only LDW when you have purchased both CDW and TP.

- Third–Party Liability Insurance/Protection (TPL) and Supplementary Liability Insurance (SLI)

If you are legally responsible for an accident, TPL covers the third party’s bodily injuries, death, and damage to property. In most countries, either you, the driver, or your rental company are legally required to purchase Third-Party liability coverage before renting a car, thus TPL is most likely already included in your rental package.

However, the amount of coverage that TPL offers can often be quite low. Thus, SLI is the type of insurance you should consider to enhance and widen your overall coverage. This typically provides between $1,000,000 and $2,000,000 of coverage.

Click here to see if you need SLI in the U.S.?

Other insurance products

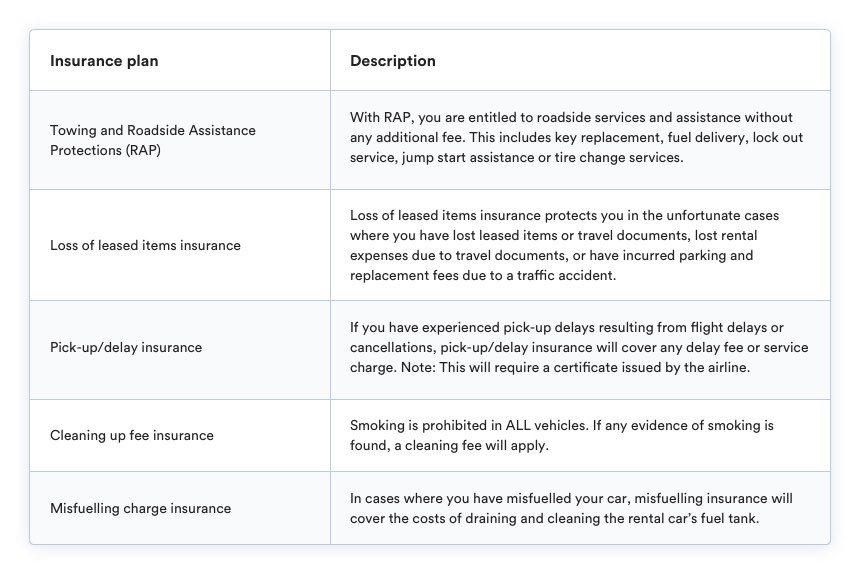

In addition to the main types of commonly offered car rental insurance plans that we’ve covered, here are some smaller, but equally important types of insurance that you may also consider purchasing which would strengthen your coverage in case of an accident.

Key Takeaways

First, if you are not covered by any life, health, or credit card rental car insurance, you should strongly consider purchasing PAI. This ensures that you and your passengers have a solid level of protection in case of an accident.

Secondly, to go one step further and increase your coverage, even more, we also recommend considering the three other most common types of insurance – CDW, TP and SLI, and other smaller types of insurance for extra peace of mind.

But most importantly, always read the terms and conditions carefully so that you are fully aware of the level of coverage you are being afforded.

Visit QEEQ.COM now.

QEEQ.COM guarantees the most competitive car rental deals for your travel and the secret is our Price Drop Protector program! We can automatically track your rental rates and RE-BOOK you if prices drop! See how our customers love this feature here.

With thanks! Valuable information!

Thank you. Glad you find our content useful! 🙂